It used to be called piggybank.ng, but now it’s called PiggyVest. It helps people save money to meet their goals.

People can also use the platform to invest their money in different businesses and get a return of up to 25% for as little as eight months or more.

Saving money can earn you up to 13% in interest.

In Nigeria, they are widely thought to be the best place to save and invest money online.

There are many ways to save money. You can save on your own or with a group.

You can save with a friend, your husband or wife, or anyone else.

You can save with anyone.

In Nigeria, the website and app are very well known.

Every day, week, or month, you waste a small amount of money.

When you save that money, it can grow into a lot of money.

Putting money away for rainy days is a good thing to do.

How does PiggyVest work?

PiggyVest works this way: You have a financial goal that you want to reach. You can use it to help you reach your goal.

It could be to start a business, pay the rent, or do anything else. It could be that you want to save one million naira, ten million naira, or even more.

You set up an account on PiggyVest and start saving money. If you have money in the bank, they will pay you interest up to 13%.

You can save every day, every week, every month, or whenever you want. There is a way for you to save your work every time.

Some people save between 50 and 20,000 or more every day. There are ways to save.

You can set the amount you want to save and it will be taken out of your account every day.

You can also decide to save money every week. Suppose you decide to save 1000 to 50, 000 a week or more.

The money can also be taken out of your bank account every week.

You can set it up that way.

You can do the same thing if you want to save money each month.

It’s also possible to save when you want, without having money taken out of your bank account to save.

In this case, it is called “Quick Save.” Choose when to save. Take the app or website, sign in and save.

That’s all there is to it. However you want to save money.

Save with a friend, family, spouse, or a group of people, too. You can also choose to save alone.

People need to know how much you want to save and for how long. Then you can start saving money right away!

When the date you set comes, the money will be sent to each account of everyone who is saving.

Many times in a year, you can’t get your money back. The reason is to keep you from getting lazy.

But you can still withdraw at any time after the withdrawal date, but you’ll pay a fee.

There is a way to keep money safe. If you don’t want to touch your money. Maybe it’s for rent, school fees, business, or something else.

You can lock it and get 13% interest paid to you right away.

The best thing about this platform is that you can make money. It’s not easy to get money for a new business, but there are many.

You can look them up and choose the one that is good enough for you to invest in. It’s very simple. A few clicks and you’re done.

For as little as #3000, you can start investing right away!

It’s hard to think about how much money you waste every week or month.

Then, you’ll be amazed at the amount of money and interest you’ll make in a year with this platform.

Is it safe to use PiggyVest?

It’s safe to save money or invest money on this platform, so you can do that.

In fact, they are registered as PiggyTech Global Limited with the name RC 1405222.

A Microfinance bank and its license were bought by them in the early part of 2018.

They are also a registered cooperative with the name Piggytech Cooperative Multipurpose Society Limited, with the registration number 16555,

and they work together for many different things.

AIICO Capital, the top asset management company in Nigeria, is in charge of all the money that people save on this platform.

AIICO Capital is registered and licensed by the Securities and Exchange Commission (SEC).

Also, your credit card information is safe, as well as the rest of your information. They don’t keep any information about you on their site.

They work with Paystack, a well-known Nigerian payment processor that is PCIDSS-compliant.

They will handle your information there, as well. The site is even safer because it has an SSL encrypted connection.

How to save money on PiggVest

Follow these steps to save money on PiggyVest:

1. Create an account

Make sure you have an account first. Making an account is very simple. Your phone number and password are all you need to get into the game! Click here to sign up for an account.

2. Choose how you want to save.

Once you set up an account. There are a lot of ways to save money. There is a PiggyBank, a SafeLock, and a Target Savings Plan. It’s your choice. Below, you can read more about each of them.

3. Set your details and start saving

The Piggy Bank lets you set how much money you want to save automatically and how often.

You can choose to save every day, every week, or every month. You can also choose to save your work when you want.

You can set how much money you want to lock and when you want to get it back.

How much money do you want to save?

This is your goal. Invite your friends if they want to join you and pick a date to leave.

How to invest money with PiggyVest

You can start investing money with PiggyVest by following these steps.

1. Create an account

First step is to create an account. The process is simple. To make an account, click here.

2. Navigate to investify

To get to your piggyVesy account Dashboard, you need to go to the top right of your screen and click on “Account.”

You’ll see a lot of choices on the screen when you look at the screen. Click on “invest for the future” or “invest now.” That’s it.

3. Check out investment opportunities and buy.

You will find a lot of different ways to make money. Choose who you want to invest in, then click on them and do it.

N3000 is the amount of money you can invest in most chances. Some people are more than other people.

4. PiggyVest features

There are a lot of different features, as it is shown below:

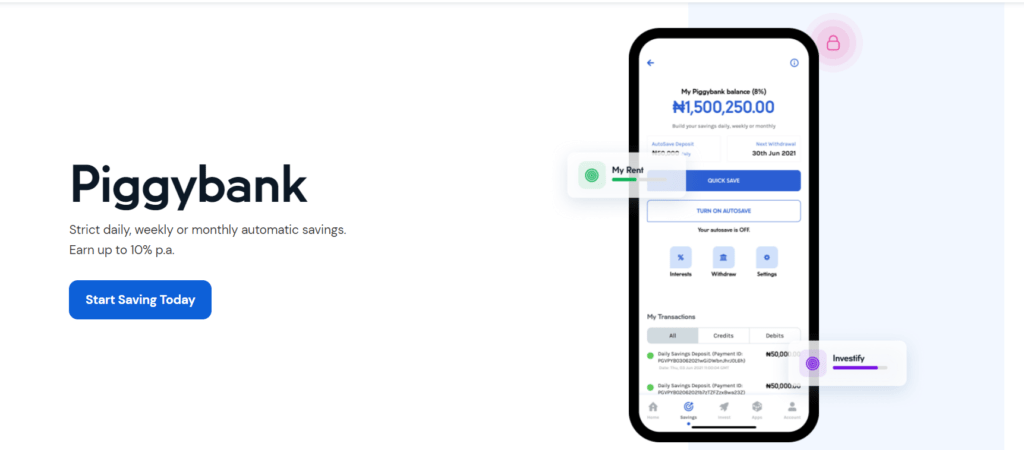

4. PiggyBank

You can find your money in PiggyBank, just like the name implies. You save money there.

If you want to save money on your own to meet your goals, then this feature is for you.

Remember all the money you spent on things that didn’t matter? It doesn’t matter how small it is.

You can save it here, no matter what. You also get to make a lot of money on it.

In a year or two, those small amounts of money will grow into a lot of money.

In a year, if you save 100 every day, that’s #36, 500. If you add in interest, that could rise to #40,000.

In a year, you can save 5000 a month, which works out to 60,000 a year, plus interest, which could make it even more.

So, if you earn 20,000 a month, you can save 20,000 a month from your salary and that adds up to 240, 000 a year,

which can grow to more than 270,000 if the money grows.

You can save as long as you like. People who save for a long time make more money, which makes their money grow even more.

You can save money every day, every week, or every month. As soon as you pay, the money will be taken out of your bank account.

As long as you don’t like that, there is an option that lets you save quickly. Quicksave lets you save money on your own whenever you want.

There is a way to save quickly, but if you choose that option, you will have to go into the app or website to save manually when you want.

You can stop saving money at any time and start again later. It doesn’t matter if you don’t have money to save for a month.

You can pause the savings or use quicksave to save.

You can also choose to increase the amount you save. Everything is yours.

You can get money out of your PiggyBank right away. It’s not that there aren’t many withdrawal dates each year.

During March, the 31st of March.

30th of June

Every 30th of September

Every December 31,

You can also change this date on your own.

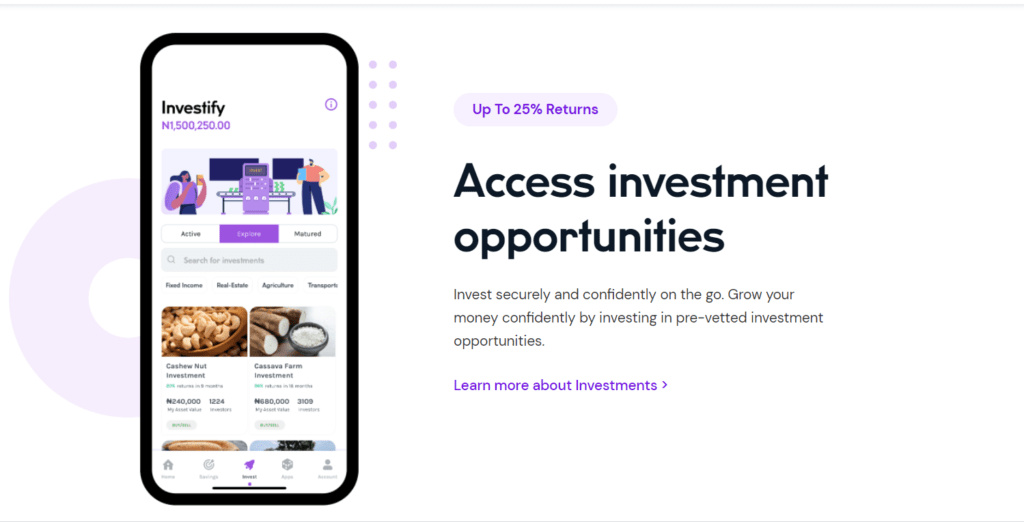

5. Investify (Invest for the future)

It is one of the features on PiggyVest that makes it easier for people to invest in low-risk investment projects.

These investment opportunities have been checked out and approved by the company. Every investment has its own safety net.

If you are worried that it won’t be covered, read up on it first. Every investment opportunity has a different insurance plan.

Investments can be made for as little as 3,000. You can get as much as 25% back from these investments with this amount of money.

Interest is paid out every month, quarter, or year, depending on how much money was invested.

You can trade your shares or sell your investment at any time.

While these investments come from other people. It’s not that PiggyVest doesn’t do their research first.

They also protect your money even more. The best thing to do is to read each investment carefully before you invest.

There are many ways to invest in agriculture, real estate, fixed income assets, and more.

6. Safelock (Lock funds away)

If someone wants to keep their money safe until a certain time, they can use Safelock on Piggy Vest.

Earn as much as 13% of the money you lock. A “fixed deposit” works like this:

It’s very simple. There are many ways to keep your money safe. You can use safelock to keep it safe until you need it.

This could be for your rent, your kids’ school fees, or even a little extra cash that you just found.

That means not to spend it. Just choose how much money you want to lock and for how long.

The interest will be paid to you right away. Whenever the time you set is up, the money will come out of the bank for you to use.

You can have a lot of safe lock accounts.

The minimum amount of money you can lock up is 1000.

7. Target savings

Feature: Users can save money on their own or with friends and family or a group of people to meet a certain goal.

Suppose you want to start a business in 12 months. You can set up a target savings account so that you can only save money for that.

You can also invite other people to help you save money. Once you meet 70% of the goal, you can withdraw on the date you set for free.

Target savings earn a 10% interest rate.

If you are going on a trip with your friends. You can set a goal for how much you want to save.

As soon as you invite your friends, each of you can start saving money.

Only 30 days can be chosen as the minimum length of time.

8. PiggyFlex

This is where all of your interest, savings, and goals are paid. From here, you can get or give money to other people.

This is where your PiggyBank savings go when you take them out. As with your investify, safe lock and target savings.

From here, you can withdraw money right away to your bank account.

Interest rates at PiggyVest are higher than those at most other banks, but they are

When you save money with them, the platform gives you money back.

10% per annum on Core Savings(Piggybank Savings)

Over 13% per annum on SafeLock

10% per annum on both Target and Group Savings

9. PiggyVest points

In this case, the point is to have a system that rewards people for saving money with the platform.

When you save money, you get points. You can turn points into cash.

In order to earn points, you have to save money In this list, we’ll look at each one.

One point is N2000 – N4999.

There are ten points for N10000–N49999.

N100000 and above is worth 55 points.

It is worth N10. That is 1 Piggy Point = N10.

There are people who work for PiggyVest who help people to invest and save.

Here are the customer care details:

Customer care phone number

The customer service phone number for PiggyVest is 0700 933 933 933, and it’s in the middle.

Customer service emails

[email protected] is the customer service email for Piggy vest, and you can reach them there.

You can get PiggyVest on your smartphone or tablet with the PiggyVest app

The PiggyVest app can be used on both Android and iOS phones.

From the Google play store and app store, you can get it To get the one that’s right for you, click here and choose the one that’s right for you!

This is the address of the PiggyVest company head office.

Onikan, Lagos Island, Nigeria, is where the head office of Piggy vest is. The address is 16 Boyle Street, Onikan, Lagos.

The PiggyVest website

The website is PiggyVest.com

To log in to PiggyVest, go to www.piggyvest.com

You can log into your account at any time through the app or the website. All you need is your email address or phone number and your password to sign in to your account.