If you’re looking for a reliable loan apps in Nigeria you can trust them any time. Most of the time,

people and businesses might need a little extra money to deal with some

financial problems that are going on in their lives or businesses.

In times like this, when there are no other ways to get money, the best thing to do is think about getting a quick and easy loan online.

The process of getting quick loans in Nigerian banks is very long and difficult for anyone who only wants to get a small amount of money for a short time.

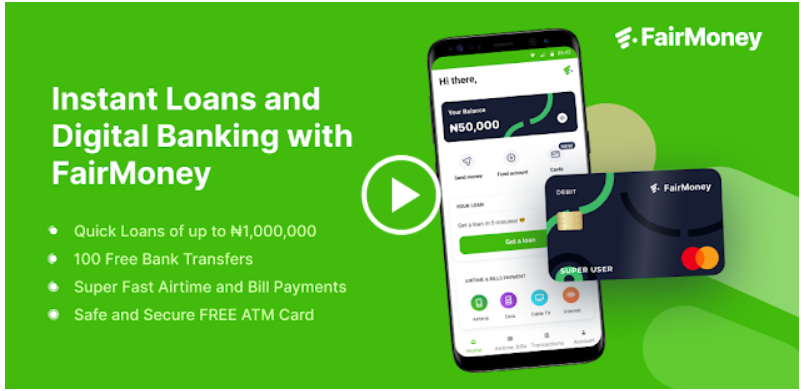

1. FairMoney

This is one of the best reliable loan apps in NigeriaPeople can get short-term loans.

From FairMoney to help pay for things like bills and business.

Using our loan application, you can get loans at any time and from any place.

Packages from FairMoney include a personal loan, an education loan, a business loan, and more.

With the help of technology, they are able to give all of our customers a quick and efficient loan app.

2. Branch

People in Nigeria and Kenya can get loans on their phones with Branch. It’s simple but also very powerful.

Branch App makes getting quick and easy loans so easy. Helps you figure out how to deal with your money in real time.

Branch has loans that range from 1,500 to 150,000. Loan terms can last from 4 to 64 weeks.

When you take out a loan, the interest rate ranges from 14% to 28%.

The equivalent monthly interest rate is 1% to 21%, depending on which loan option you choose.

Download Branch App for access to quick and instant loans.

3. QuickCheck

QuickCheck is a modern way for people and small businesses to get loans.

QuickCheck uses mobile technology to help people and small businesses get money.

It says that users can get quick and easy loans of up to 30,000 Naira without having to put up any collateral for 15 or 30 days.

You can get the QuickCheck App on Google Playstore.

4. Palmcredit

PalmCredit is another reliable loan apps in Nigeria with the support of a virtual credit card.

It makes it easy to get a loan at any time and from any place.

Palmcredit lets you get loans of up to 100,000 on your phone in just a few minutes.

With PalmCredit, it’s easy to get a loan for your cell phone. The process to get your credit limit only takes a few minutes.

Then you can get as many instant loans as you need without having to go through any more approval steps.

The credit revolution is going on now

As soon as you pay back, your credit score is changed.

The more money you pay back, the more your limit will grow to N100,000.

Download the Palmcredit App to get quick and easy loans at low prices.

5. Paylater

When someone in Nigeria has an unexpected expense or needs money quickly, they can get a short-term loan from Paylater,

which is easy to use and entirely online.

With Paylater, you can get a loan of up to 500,000 Naira without having to put up any money.

Once your application is approved, funds are usually sent to you in 1 to 3 business days.

Making on-time loan payments can give you more credit for your next loan.

Paylater is an app that lets you get quick, flexible loans at low rates. You can download it.

Conclusion:

Most of these platforms say that they can get you a quick loan with no collateral,

but it’s important to read their terms and conditions (T&C) first.

Another thing to think about is the interest rate and the time it takes to pay it back.

As a business, you don’t want to take out loans with short payback periods unless you’re sure you’ll be able to pay them back quickly.