Best 4 Budgeting Apps in 2022 are currently out there, If you’re looking out for the best money managing apps you can use

right now, we’d be looking at some budgeting apps you can use to manage your money and other finances.

1: Quicken Budgeting App

Quicken is one of the most established personal finance platforms on the market that currently manages different

aspects of your financial life such as budget creation, debt tracking, savings goals, and investment coaching.

The software also features Excel exporting, it allows you to manipulate and perform additional calculations on your data,

which is a really nice feature that most apps don’t offer.

Now a really cool feature that they offer is paying your bills straight through the app.

That means that going through different bank accounts, different credit card accounts,

everything is in one spot and they will pay your bills there for you. And you can track that there as well.

And also check out your total net worth which is done by them tracking the value of your assets.

If you want to go for more of the premier side of the app. They do offer features like property management,

which can help you go through your rental process with your tenants, and other features.

Now depending on what platform you want to use, if you want to go on the Mac side there are three different plans

you can choose, from standard deluxe and Premier.

If you’re on the Windows side there are four different plans you have the standard so that the box premiere

and then the home and business which is the most expensive, but you get every single option from everything

so it’s the highest you can go and like I said it’s for Mac and Windows but there’s also iOS and Android.

This is one of the best Budgeting Apps to Manage Finances.

2: Mint Budgeting App

Mint is known as one of the best budgeting apps currently out there. And software can pull your bank and credit card information

and will analyze that data and show where you can cut back to improve your finances.

You can also set up alerts that can help you with due dates and low bounces to keep you on track.

This will also help you avoid expensive fees such as late payments or overdraft fees on your bank account.

One really cool feature is budget categories, which gives you real-time data on the amount you can spend

on things like food and gas or other things that you have.

You can check any investments that you have and also if you do have loans, you can track those as well.

But the best thing about this app this is completely free. It may not be very high-end like some of these

other apps but what you get for free is definitely worth it. It’s a great starter platform for those that

are beginners and you can use it on iOS Android and desktops.

This is another Budgeting apps to Manage Finances.

3: Everydollar Budgeting App

Everydollar is better suited for families but individuals can use it as well. But it’s a great tool that will help you manage

your finances as a family really cool thing about this platform are that it was created by the financial expert Dave Ramsey.

If you don’t know who he is, he’s a host an author, and a businessman.

He’s been very successful in the financial world.

But the best thing about this app is that it only takes 10 minutes to completely customize your family’s plan.

Some of these apps are more geared towards you know individuals and not so much family so this is a really nice

way of keeping your family on a budget basically syncs across all devices.

So you don’t have to just have one computer. Everyone can kind of see where the money’s being spent.

Whether it’s on your phone or you know desktop it’s an ideal choice for families because it is free to use.

You don’t get every single feature there is another higher paid plan.

But for families that want to learn how to budget and do that for free, the more hands-on this is definitely suited for them.

If you’re on the free version, you will have to enter in manually any of your transactions and you will also be excluded

from leaking bank accounts. So if you want to have you know more features and you will have to pay for the premium plan.

One interesting thing I did see for every dollar for upgrading your plan to the premium plan is a program called Baby steps.

I don’t think paying the premium hire 30 hours a month to have this stuff is necessary.

You can find that information anywhere online. So it’s not really useful in my opinion for what you spent.

I’ve run over a multiple of these steps on my own videos. So I don’t think it’s personally worth it.

This is a great Budgeting Apps to Manage Finances.

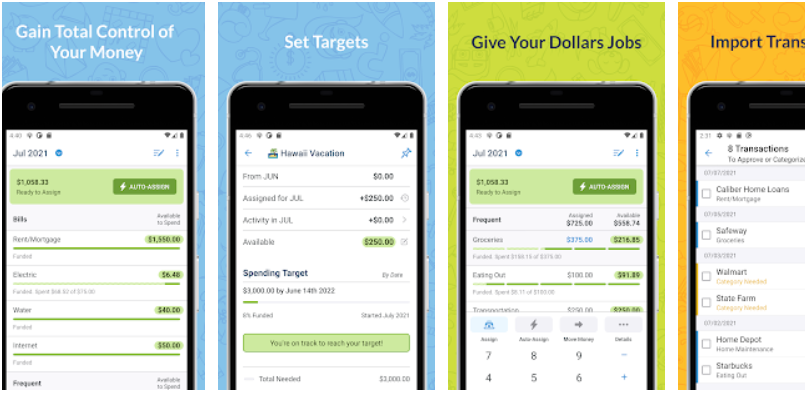

4: Ynab Budgeting App

There are personal financial software that is aimed to help you with your financial literacy and help you manage

your monthly budget by creating your budget and managing your daily finances.

The app also does offer tutorials. They’re there to help you tackle some of the tougher financial topics.

The software automatically links to your bank account, integrating your spending information for analysis and budget tracking.

You can also keep tabs on tracking your monthly budget and kind of where to take action if necessary.

One of the downsides to this app is that there are no investment capabilities to track.

This is a nice feature to have, especially because there are a good amount of people that invest that could be such things

as your Roth IRA or you know your stock accounts pretty much any investment accounts.

This platform is not free. It does come with a free trial at first I believe right now it’s for 34 days,

but that can change probably just for the holidays right now.

Normally if you want to pay monthly it’s 1199 per month, or you can do an annual for $84 for the year.

One neat thing they do offer is a money-back guarantee.

If you feel as if you’re not in control of your finances, if you don’t think that meant offers not for you

and you are more of an intermediate-advanced investor or just trying to budget and save.

You can use these Budgeting Apps to Manage Finances.

Conclusion:

I would recommend Quicken I think it’s probably the best bang for your buck.

There are so many tools there are too many tools that you probably wouldn’t even use them all.

But I think it does offer the best range of tools on the market right now.

Overall I do think Mint is the best platform out there. It is free to use.

You have so many tools at your disposal.

And these other apps are very good and qualified apps but they all do have some kind of plan

that you had to pay for if you want to keep using the service.

And whereas meant you’re getting all these things for free.

And most of these other apps, they just those efficient tools that MIT doesn’t offer.

Don’t seem worth it to me as a beginner investor and some of those who wants to track their money.